fanduel tax rate|Fantasy Football, Fantasy Baseball, Fantasy Basketball and : Bacolod FanDuel will issue a Form W-2G for each sports betting transaction when both of the following conditions are met: 1. Winnings (reduced by wager) are $600.00 or more; and 2. . Tingnan ang higit pa ThotHD is the biggest free porn tube video and photo gallery website with the hottest amateur thots on the internet. Find the craziest and naughtiest teens, milfs, amateur girls, celebrities. . Husvjjal OnlyFans Video 2 0:09. 0% 6 months ago. 7.8K. Husvjjal OnlyFans Titties 0:41. 50% 6 months ago. 10K. Husvjjal Leaked OnlyFans See thru 0:39. 0%

fanduel tax rate,We’re legally required to withhold federal taxes from winning transactions on horse race wagering when both of the following conditions are met: 1. Winnings (reduced by wager) are greater than $5,000.00; and 2. Winnings (reduced by wager) are at least 300 times the amount of the wager Tingnan ang higit pa

The Player Activity Statement is a summary of your FanDuel wallet and gameplay activity. It summarizes transactional movement such as deposits, withdrawals, winnings, bets, and more. Learn more about the Player Activity Statement . Tingnan ang higit paA Form W-2G reports gambling winnings and any income tax withheld on those winnings. Reporting and withholding requirements . Tingnan ang higit paFanDuel may be required to report your activity on its Daily Fantasy Sports/Faceoff products to the IRS and applicable state taxing authorities based on the IRS Form 1099 . Tingnan ang higit paFanDuel will issue a Form W-2G for each sports betting transaction when both of the following conditions are met: 1. Winnings (reduced by wager) are $600.00 or more; and 2. . Tingnan ang higit pa

FanDuel Sports Betting Taxes. How States Tax Legal Sports Betting. Frequently Asked Gambling Tax Questions. Unless you hate money, your primary goal .

If you use online sportsbooks like DraftKings, PointsBet, and FanDuel, you might need to pay taxes. Learn the taxes you’ll pay, how to file your sports betting taxes, .

Explore the complexities of tax regulation compliance for Fanduel players in this comprehensive guide. Discover the significance of documenting both cash and non .fanduel tax rate FanDuel Sports Betting Taxes Guide: Do I have to pay taxes on my FanDuel winnings? How Much Does FanDuel Tax? Does FanDuel take taxes out .Fantasy sports leagues can yield hefty winnings if Lady Luck smiles on you. If you win big—or even not so big—you'll need to save a portion of that money for the Internal . FanDuel, as a responsible payor, adheres to IRS guidelines and withholds federal tax from certain winnings. This includes winnings over $600 in a year, from off .

Fantasy Football, Fantasy Baseball, Fantasy Basketball and© Betfair Interactive US LLC, 2024 If you or someone you know has a gambling problem or wants help, please check out our Responsible Gaming resources. Reporter. Nearly half of sports betting revenue goes untaxed in four states. Companies angle to expand ‘free play’ tax perk to more states. FanDuel and DraftKings .

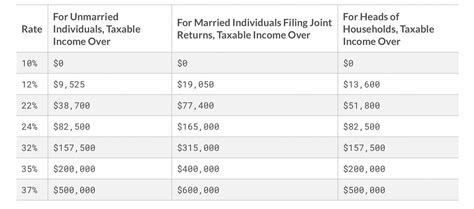

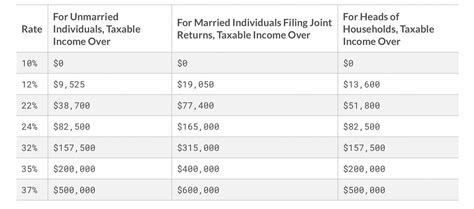

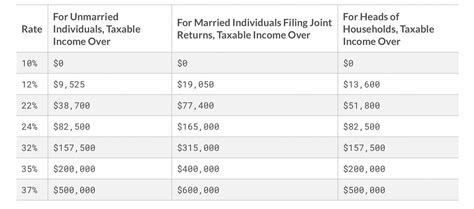

FanDuel is the leader in one-day fantasy sports for money with immediate cash payouts, no commitment and leagues from $1 This means they’ll be subject to the same tax rates as any other earnings – ranging from 10% to 37% based on income brackets for 2021. For casual gamers, on the other hand, Fanduel winnings are more akin to lottery winnings and . Every time bettors lose a $1,100 bet, they lose $1,100. But every time sportsbooks lose a $1,100 bet, they only lose $1,000. So if a bettor makes 10 wagers of $1,100 each and goes 5-5 on those .A user accesses the mobile FanDuel sportsbook. Business Wire via Associated Press. New York has reaped the rewards of mobile sports betting, but operators warn that the state's high tax rate could .© Betfair Interactive US LLC, 2024 If you or someone you know has a gambling problem or wants help, please check out our Responsible Gaming resources.

If you use your Apple ID or Facebook account to log in to a FanDuel app, you will need to reset your password. Connect your account If you or someone you know has a gambling problem and wants help, call 1-800-522-4700 or chat at ncpgambling.org .© Betfair Interactive US LLC, 2024 If you or someone you know has a gambling problem or wants help, please check out our Responsible Gaming resources. If you happen to lose money with a brand like FanDuel Ohio, make sure you keep track of things if you plan to deduct. . Yes. In Ohio, the tax rate for the operators is 10% of the gross revenue. For the bettors, gambling winnings are taxable income like any other. You're required to keep track of and report any winnings on your tax return, and .Fantasy sports winnings of $600 or more are reported to the IRS. If it turns out to be your lucky day and you take home a net profit of $600 or more for the year playing on websites such as DraftKings and FanDuel, the organizers have a legal obligation to send both you and the IRS a Form 1099-MISC. If you receive your winnings through PayPal .

fanduel tax rate|Fantasy Football, Fantasy Baseball, Fantasy Basketball and

PH0 · Understanding Fanduel Earnings Taxes: Common FAQs Answered

PH1 · Taxes & Forms

PH2 · Taxes

PH3 · Tax Considerations for Fantasy Sports Fans

PH4 · TVG State Specific Rules

PH5 · Sports Betting Taxes: How to Handle DraftKings, FanDuel

PH6 · How Much Taxes Do You Pay On Sports Betting?

PH7 · Fantasy Football, Fantasy Baseball, Fantasy Basketball and

PH8 · FanDuel, DraftKings Save Millions on Taxes Thanks to Free Play

PH9 · FanDuel Taxes 2023: How to Pay Taxes on Betting Winnings & Losses

PH10 · FanDuel Taxes 2023: How to Pay Taxes on Betting Winnings

PH11 · Effective Strategies to Handle Tax Withholding on FanDuel Winnings

PH12 · Effective Strategies to Handle Tax Withholding on FanDuel